A sales tech stack plays a critical role in a sales team's success, but how have sales tech stacks evolved, and where are they going next? GetAccept partnered with Pavilion to survey sales and marketing professionals about the digital selling tools they use and their benefits.

What is a sales tech stack?

Your sales tech stack is like a painter's toolkit, except instead of brushes and paint, it's made up of software and applications.

Just like a painter carefully selects their tools based on the style and vision of their artwork, a salesperson carefully selects their sales tech stack based on their sales process and goals. And just like a painter can create a masterpiece with the right tools, a salesperson can be more efficient, close deals, and drive revenue with the right sales tech stack.

A sales tech stack can be a trusted friend or a source of stress for sales reps and their team leaders. A great, well-integrated tech stack can bring in more deals and increase revenue, while a poor tech stack often costs teams time and money.

GetAccept and Pavilion surveyed 71 sales and marketing professionals to understand how sales teams use digital selling tools and how teams can get more value out of their tech stacks.

Most sales tech stacks have between 4 and 10 tools

It should come as no surprise that most sales teams have invested in at least one digital sales tool.

We found that 97% of survey respondents use at least one digital selling tool.

What’s more, about two-thirds of sales teams (67%) use between 4 and 10 digital selling tools as part of their sales tech stacks..png?width=960&name=Pavilion%20Benchmarking%20Guide%20(3).png)

As sales tech continues to evolve, it will impact how many tools companies use long-term. Distributed work has led to an increase in demand for integrated tools to reduce time spent on admin work and make sales processes more efficient.

Between four and ten sales tools might seem like a lot for teams to manage, but as demand has grown for remote selling at scale, it’s also getting easier and less costly for teams to have multiple tools for unique roles on their team.

Nicolas Vandenberghe, CEO of Chili Piper, says the best tech stacks have different tools for different jobs, and usually start with customer relationship management (CRM) tools as a foundation.

“There are different solutions for different jobs,” Vandenberghe says. “You see companies… trying to be everything to everybody but the opposite is happening. Each job is going to get a more specialized tool.”

Each job is going to get a more specialized tool.” - Nicolas Vandenberghe, CEO @ Chili Piper

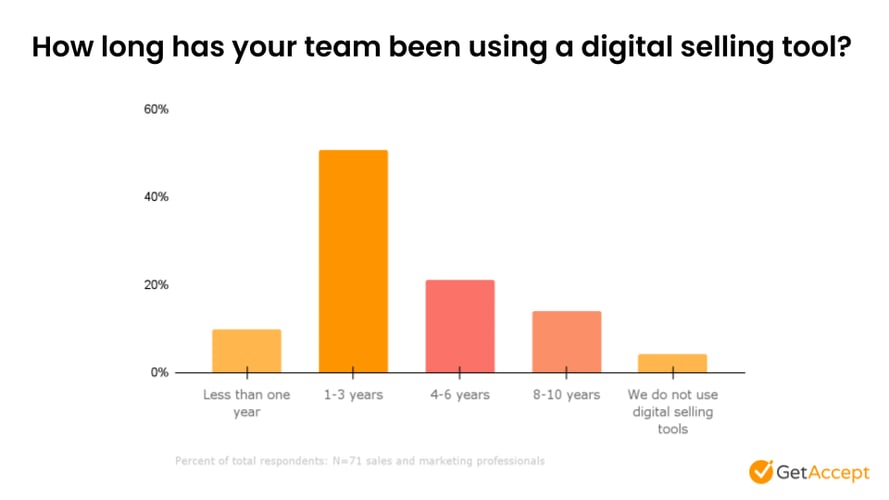

More teams have adopted sales tech tools in the last few years

The last year has brought unprecedented changes to the way businesses run their sales operations. The accelerated pace of digital transformation means many organizations had to expand their tech stacks quickly.

About half of survey respondents (51%) have been using digital selling tools for between 1 and 3 years, coinciding with the onset of the COVID-19 pandemic.

In the past 1 to 3 years, sales teams that once were able to fly teams out for pitch and product demo meetings now have to rely on software to close the deal. Businesses sidelined in-person professional development in favor of virtual training options. And, above all, sales teams needed tools that integrated and created cohesive experiences.

Still, sales were trending digital long before the onset of the COVID-19 pandemic. 86% of sales teams have been using a digital selling tool for at least one year.

“[A lot of our customers] went from not much to so many things that are integrating, which can be challenging,” says Chris Rothstein, CEO of sales engagement platform Groove.

As the sales landscape evolves and many newer sales tech tools start to mature, Rothstein predicts tools with different functions will start to consolidate before eventually spreading out again.

The past 1-3 years have seen a huge boom in digital selling tools available on the market beyond traditional tools like CRMs and project management software. It’s now on the software providers themselves to differentiate themselves based on value-added rather than pain reduced.

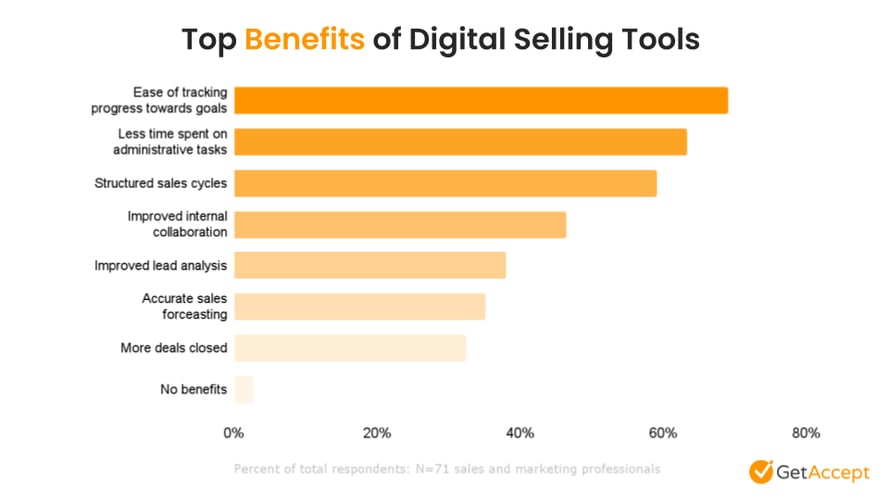

Digital sales tools have many benefits for sales teams

Digital selling tools might be a necessary part of sales tech stacks, but does that mean businesses have been able to benefit from their use?

More than two-thirds of survey respondents (69%) say the biggest benefit of using digital sales tools is the ease of tracking progress towards goals.

Almost two-thirds of respondents (63%) said a top benefit of using digital selling tools was decreased time spent on administrative tasks. More than half of respondents (59%) also appreciated the structured sales cycles digital selling tools offer.

Improved internal collaboration is a benefit for about half of respondents (46%), while 38% of respondents experience improved lead analysis as a result of their digital selling tools.

Finally, around a third of respondents say accurate sales forecasting (35%) and an increased number of deals closed (32%) are benefits of digital sales tools.

Even though more deals closed is the least popular benefit of digital sales tools, other popular benefits indicate that sales tech stacks create a single digital environment that enables sales teams to optimize important processes.

Reducing administrative time, in particular, can be massively beneficial for sales teams. One study found that sales professionals spend 21% of their time on administrative tasks. Using a sales tool to automate a process like inputting emails for outbound sales cadence, for example, could give sales reps some of that time back.

Listen to Justin Barth, Sales Manager at Algolia, discuss modern sales tactics to use the full breadth of digital:

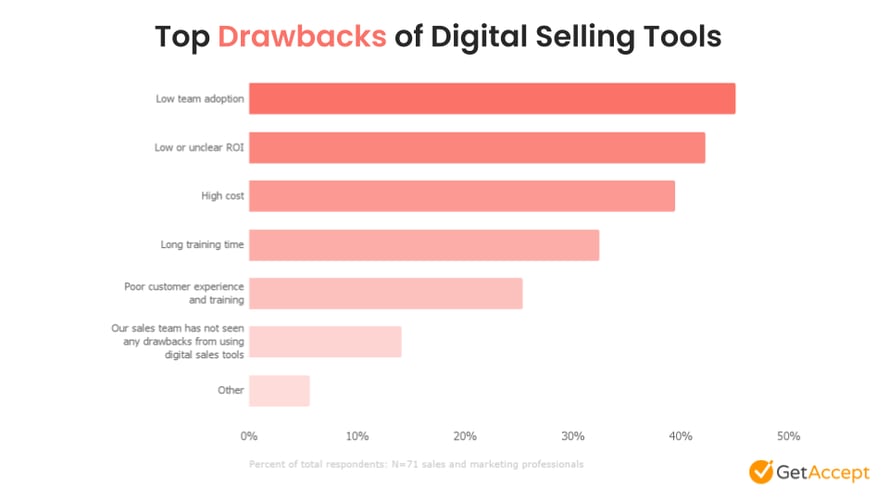

Team-wide adoption is the biggest challenge for sales teams investing in tech

Sometimes, sales software is only as good as its usage.

Almost half of the survey respondents (45%) say one of the biggest drawbacks of digital selling tools and software is low team-wide adoption.

Other drawbacks of digital selling tools include low or unclear return on investment (42%), high cost of the software (39%), long training time (32%), and poor customer experience and training.

Common drawbacks sales teams experience with their tech stacks can have compounding effects. Low team-wide adoption of a project management tool, for example, can mean missed deadlines and stalled project progress because important stakeholders aren’t clued in on key activities.

Sales team leaders are responsible for selecting useful software and then communicating the value of that software to their teams effectively. SaaS companies, in turn, have a responsibility to educate their customers on how to use their products.

Effectively communicating a sales tool’s value can also mitigate the negative impact of “sticker shock” at a pricey new tool and buyer’s remorse if teams are slow to ramp up on that tool.

Sales tech, in general, is more affordable now than ever before. The cost of a CRM, for example, can start as low as $20 per user per month. B2B customer experiences are also slowly but surely becoming more like B2C experiences, where self-service and a la carte pricing maximize choice for buyers and ensure they don’t pay for more than what they need.

Ultimately, it’s all about the value a tool has or will have for a sales team’s bottom line.

How can sales tech companies help buyers see value in digital sales tools?

B2B SaaS companies, particularly in sales, face the unique challenge of selling to buyers who are just like them – hesitant to invest in a tool without a proven ability to impact revenue.

An increase in revenue often comes down to many different factors, such as staffing and product updates. It can be difficult for sales teams to isolate the impacts of their software amidst all the external factors.

To better demonstrate the value of an individual sales tool, Rothstein asks customers about specific outcomes they hope to achieve when using Groove’s software.

“Oftentimes we’ll work with a customer and ask “what is your specific goal?” Rothstein says. “We generally don’t keep [revenue] as the core guideline because it’s just one of many things.”

Understanding the usage of a software tool can also help buyers understand its value.

“Usage alone is very, very useful,” Rothstein says. “Sales reps especially aren’t just using something for the fun of it… Oftentimes if they’re choosing to use something they inherently believe it’s helping them, which is a signal on its own.”

Sales teams can help buyers connect with their tool’s value by connecting the essential pain point the product solves to the buyer’s bottom line.

“At the end of the day, you have to tie back to revenue in all of your ROI documents and proof points,” Vandenberghe says.

Customer experience is a challenge for digital sales tech

Customer experience is no longer the sole domain of customer success managers. Every team, from product to marketing to sales, has a role to play in optimizing the customer experience.

One in four survey respondents says poor customer experience was the biggest drawback of using a digital sales tool.

Customer experience is closely related to team-wide adoption: if a sales rep or sales team leader has a poor experience using a sales tool, they won’t come back to it.

Improving the overall customer experience in sales tech stacks should be top of mind for SaaS companies. Sales teams in particular often have complex, specific needs from their tech stacks, leading to the creation of complex tools that are challenging to use.

“We solve complex problems,” Vandenberghe says, “and it’s difficult to create a great UX for complex problems.”

To counteract the slow buildup of complex features that impede on a sales team’s user experience, Vandenberghe’s team at Chili Piper is committed to constantly rethinking and improving the user experience of apps themselves. Investing in UX research is one way SaaS companies in any industry can make inroads with customers.

Improving the customer experience comes down to improving the overall usability of a tech tool and removing “annoyances” that get in the way of a customer being able to get the most out of the tool.

Tracking customer experience can be difficult, but Jeron Paul, CEO of sales commission SaaS platform Spiff, cautions against tracking metrics such as time spent in-app to determine the types of experiences customers are having.

“I think we’re at a moment culturally and in tech where time-in-app needs to die,” Paul says. "The future is much less about time-in-app and much more about the value you’re creating and the experience your users have coming out of your app and tackling the challenges of their life.”

"The future is much less about time-in-app and much more about the value you’re creating and the experience your users have coming out of your app and tackling the challenges of their life.” – Jeron Paul, CEO @ Spiff

Sales tech stacks will streamline and evolve in 2023

Sales teams rely on their tech stacks to streamline operations and boost efficiency. By making critical sales processes more efficient, sales tech stacks help teams improve their overall revenue in the long-term.

The top benefits of sales tech stacks include increased pipeline visibility, improved sales cycles, and reduced administrative time. The drawbacks include high cost, low team-wide adoption, and unclear ROI.

Evaluating a tech tool is often a complicated process. Sales teams must remember to help their prospects understand the true value of the tool and how it impacts the bottom line.