Quote-to-cash (QTC or Q2C) shouldn’t be a slow, messy process. But it can be. Fortunately, the right tools have the power to cut errors, speed up deals, and make collaboration effortless.

In this article, we take a look at the challenges you’re likely to face in a traditional process and how technology like proposal software can help you to tackle them. We also include a checklist to help you quickly spot where your QTC process can be optimized.

What are the steps in the quote-to-cash process

The QTC process starts with product configuration and pricing, where CPQ (Configure, Price, Quote) tools help sales teams pick the right products and set accurate prices. From there, a quote is generated, followed by proposals and contract creation, keeping everything professional and streamlined.

Next comes negotiation and collaboration, where teams use digital tools to speed up approvals and lock in the best deal. Once signed, order management systems take over, ensuring everything gets delivered smoothly, while billing software and finance automation tools handle invoicing and revenue tracking. Finally, renewals keep customers coming back, managed by subscription platforms that make upselling easy.

Proposal software like GetAccept fits in at multiple stages, helping you move faster, collaborate better, and close deals with way less hassle.

The Q2C tech stack

There are a number of tools involved in the traditional quote-to-cash process. These technologies help automate tasks, reduce errors, and speed up deal cycles. Here’s a breakdown of the main ones:

Customer relationship management (CRM): The central hub for managing customer data and tracking interactions throughout the sales process. Examples: Salesforce, HubSpot, Microsoft Dynamics 365

Configure, price, quote (CPQ) Software: Automates the process of selecting products, setting prices, and creating quotes. This ensures consistency and accuracy. Examples: Salesforce CPQ, Oracle CPQ, Apttus CPQ

"Complexity in QTC is associated with slower sales motion, poor customer experience, and ultimately decreased ability to grow. Higher-growth companies consistently demonstrate a set of QTC practices that help minimize internal friction through standardization and yet retain the flexibility to meet the critical needs of customers."

Dash and Deveau, How quote-to-cash excellence can fuel growth for B2B subscription businesses, McKinsey

Enterprise resource planning (ERP): Helps manage order processing, inventory, and financials, making sure everything runs smoothly after the sale. Examples: SAP ERP, NetSuite, Microsoft Dynamics 365 Finance

Proposal and contract management software: Often combined in the same tool, this makes it easy to create, send, and track proposals and contracts, saving time and improving accuracy. Examples: GetAccept, PandaDoc, and Oneflow.

E-signature software: Speeds up the signing process with secure, digital signatures that are legally binding. E-sign software can also be a part of a more comprehensive proposal software solution like GetAccept, helping to better consolidate your tech stack. Standalone examples: DocuSign, Adobe Sign, HelloSign.

How proposal software and contract management tools elevate your Q2C process

In a nutshell, this tech pairing streamlines the entire sales process, making it faster, smarter, and more efficient.

|

7 common challenges in the quote-to-cash process

The quote-to-cash process is full of moving parts. And when things aren’t running smoothly, businesses face some pretty big challenges. Here are some of the most common roadblocks in the process:

-

Complicated pricing and configuration

Pricing and product configurations can quickly become complex. With multiple pricing models, discounts, and product bundles to manage, it’s easy for mistakes to happen. Without automated tools to ensure accuracy, teams can spend more time than necessary creating quotes and configuring products, causing delays.

-

Disconnected systems

When different departments use separate systems — like CRM, billing, and ERP platforms — data can get siloed. This means that important information isn’t easily shared, leading to mistakes or slowdowns in the process. Sales reps and finance teams end up manually entering data multiple times, which increases the chance of errors.

-

Slow contract negotiations and lost deals

Negotiating contract terms can be a lengthy process. Without clear workflows or automated tools, sales and legal teams may find themselves bogged down in back-and-forth discussions, delaying the deal from closing.

"Companies that prioritize Lead to cash innovation are also seeing intangible benefits across the value chain from prospecting a lead to final payment in a reduction in complexity, increased speed of decision making, and reduced risk in unique contract structures."

McKinsey & Company, Lead to Cash Executive Roundtable, 2024

-

Manual, error-prone processes

Many businesses still rely on outdated methods like spreadsheets or email chains to create quotes, track contracts, and generate invoices. These manual methods are both time-consuming and prone to human error. Both of which can lead to lost revenue or missed deadlines.

-

Lack of collaboration between teams

A successful quote-to-cash process requires collaboration across multiple teams. Like sales, finance, and legal, for example. If these teams aren’t using the same tools or working closely together, communication gaps can lead to delays, confusion, and missed opportunities.

-

Poor visibility and forecasting

When the quote-to-cash process is not streamlined, it can be difficult to get clear insights into where deals stand or accurately forecast revenue. Lack of visibility makes it hard for businesses to track performance, plan for growth, or make data-driven decisions.

-

Payment and invoice delays

The final step in the process — getting paid — can often be delayed because of slow invoicing or poor tracking of payments. Without automated systems to remind customers of outstanding invoices or monitor payment status, businesses can face delays in cash flow and miss out on opportunities to close the loop on sales quickly.

The good news is that these challenges aren’t set in stone. With the right tech in your corner, you can turn the tide. By integrating tools like CRM, CPQ, and contract management software, you can automate tedious tasks, eliminate errors, and get your teams on the same page. The result? A smoother, faster quote-to-cash process that doesn’t just save time — it boosts your bottom line and sets you up for growth.

How the right technology can streamline your quote-to-cash process

The right tools don’t just speed up sales — they remove roadblocks, reduce errors, and improve collaboration. From proposal software to CRM and contract automation, here’s how technology streamlines the process:

Simplify and automate processes

Manual data entry slows everything down. Proposal software automates quote creation by pulling accurate pricing and product details from your CRM. Automated reminders keep deals on track, while data syncing ensures every system stays updated.

Dynamic, error-free quotes and contracts

Forget outdated pricing and version confusion. Proposal software lets you generate interactive, real-time quotes that update instantly based on CRM and CPQ data. You can also attach extra materials, like case studies or demo links, for a stronger pitch.

Smoother negotiation and collaboration

Negotiating shouldn’t be a headache. Proposal software allows buyers and sellers to chat, comment, and adjust quotes in real time. No need to resend files or dig through emails — updates sync instantly, so everyone stays on the same page.

Faster order fulfilment and billing

Once a contract is signed, the next steps should be effortless. Proposal and contract management tools push deal details directly to CRM systems, reducing manual work and speeding up invoicing and payments.

Automate contract management

Renewals and follow-ups shouldn’t slip through the cracks. Contract automation tools send alerts before a contract expires, making it easier to secure renewals. Automated workflows also trigger personalized follow-ups to keep customer relationships strong.

A better buying and selling experience

The right tech stack creates a smoother, faster sales process. Buyers get quick responses and interactive proposals, while sellers close deals with fewer admin tasks. With proposal software in place, businesses can cut inefficiencies and focus on growth.

Quote-to-Cash checklist for optimization

Want a smoother, faster quote-to-cash process? Make sure your tech stack checks these boxes:

✅ Automated workflows: Are you reducing manual work and speeding up approvals?

If you’re missing any of these, it might be time to upgrade your process. The right tools make all the difference. |

Wrapping up

A clunky quote-to-cash process slows deals, creates errors, and frustrates both buyers and sellers. The right tech stack changes that. By automating workflows, syncing data, and streamlining contracts, businesses can cut manual work and speed up sales cycles.

Proposal software like GetAccept brings it all together — helping teams create dynamic quotes, collaborate with buyers, and close deals faster with e-signatures and contract automation.

If inefficiencies are holding you back, now’s the time to rethink your approach. The right tools don’t just simplify Q2C — they make revenue flow.

Simplify. Sync. Sell.

Chaos-free QTC with GetAccept.

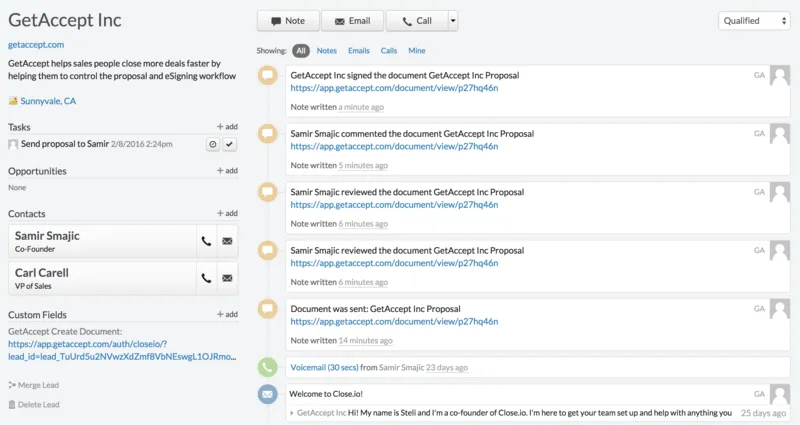

GetAccept in your CRM

Check out our integration options. Salesforce, HubSpot, MS Dynamics, Pipedrive, SuperOffice, Lime, and more...

![[Guide] Everything you need to know about CRM & integrations](https://www.getaccept.com/hubfs/Blog_Thumbnail_integration_guide.webp)